DisobeyArt/iStock via Getty Images

DisobeyArt/iStock via Getty Images

Dear readers,

I’ve invested in and sold off Molson Coors (NYSE:TAP) a few times over the past couple of years. When I bought Molson Coors Brewing Company last, the company’s share price had essentially fallen off a cliff following an M&A that left the previously fairly leveraged company overleveraged, forced to freeze the company dividend, and facing increasing competition from new brands, craft brewing, and other competitors.

Since that time, the company has reintroduced a dividend and changed some things. But the company may still not be in an ideal position for any sort of large investment here.

Let me show you my rationale.

It’s been some time since I last looked at Molson Coors. The company, in its current iteration, was formed in 2005 by the merging of the Canadian brewer Molson and the American brewer Coors. The current company size includes the MillerCoors stake sold to the company in the Anheuser-Busch InBev (BUD) and SABMiller merger of 2016 which caused a large company expansion that made the company the 7th-largest brewer in the world in terms of pure volume. It also made the company the largest brewer in the USA.

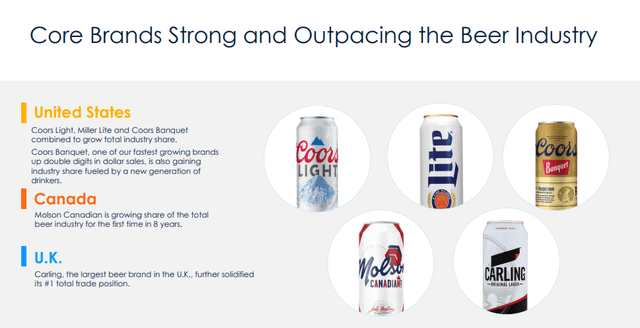

Its portfolio consists of a large number of extremely popular brands, including Coors, Miller, Hamm’s Blue Moon, Grolsch, Newcastle, Strongbow, and many others. They own many high-tier beers, ciders, and alcoholic beverages found across the world. They have, like many brewers, a craft portfolio as well as what the company calls above-premium brands.

It also has market-dominant positions in key markets.

Molson Coors IR (Molson Coors IR)

Molson Coors IR (Molson Coors IR)

As of the current portfolio, it’s the largest and most premium-product portfolio since the Millers Coors Acquisition back in 2016 – and it contains the fastest-growing hard seltzer products on the market. We’ve also seen the maturing of the above-premium portfolio. By mature, I mean that the company’s portfolio when it comes to this part is now larger than the company’s economy portfolio in the US.

There are key products driving sales and growth here.

TAP IR (TAP IR)

TAP IR (TAP IR)

This does not mean that economy brands, such as Keystone, Miller, and others are performing poorly. These brands continue to grow their segment share in 2Q22, with the economy performance shining with the best quarterly performance on an industry basis for the past three years.

From being a problematic player with issues, the company has improved its net sales and revenue growth at a good pace for five consecutive quarters, managing cost increases and inflation, and grew its dollar shares for the first time in over a decade.

Concise results for 2Q22 show us a 2.2% sales increase with a growing Brand volume as well – but down 22.8% in underlying pre-tax earnings. The cause was increased G&A, travel & entertainment costs, marketing investments and other typical expenses that are needed to drive brands such as these forward.

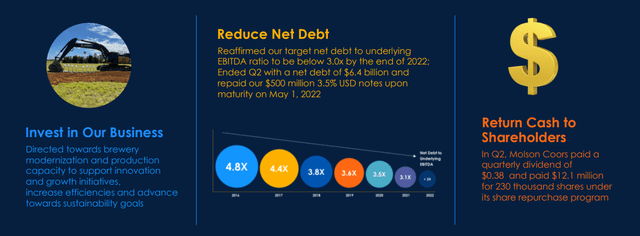

The company’s capital allocation priorities remain very focused – business investments, reduce that net debt even further to the company’s <3x target, and finally returning long-awaited cash to shareholders.

TAP IR (TAP IR)

TAP IR (TAP IR)

The company also reaffirmed 2022E guidance with a mid-single-digit sales growth on constant FX, income growth, and around $1B worth of FCF for the full year.

However, let’s not become too exuberant on Molson Coors. The company’s performance still leaves room for significant improvements in terms of efficiencies. G&A CapEx shows us that the company still operates with perhaps a bit too much flexibility compared to the otherwise cost-focused industry – especially with input inflation and labor cost increases. Companies need to be focused on cost control and delivering continued improvements – improvements that other peers have already done.

My article history shows how much the company has struggled over the past few years – even if during 2022, the company has actually performed rather well. Not an easy feat, given what we’re seeing on the market today.

The company remains strongly NA-centric, but with the merger and the international expansion going forward, the company will grow its international presence further and actually provide a profit from its international segment.

TAP has been improving its fundamentals for going on 2-3 years now. The company’s position is far better than it was back in 2020. It’s not that I don’t applaud the company for improving its fundamentals. I believe, however, that companies should always have a “dividend floor”. If they don’t have this, they’re not planning as well as they should. This company eliminated its dividend for some time, indicating poor planning.

We also need to remember that the global brewing industry is one of the most competitive places there is. It’s somewhat fragmented – but it doesn’t, at the same time, lack players the size of Constellation Brands (STZ), Budweiser, or as in this case, Molson Coors. Brewers compete for both international as well as local market share. Beer and similar beverages aren’t going anywhere. Molson Coors is in a difficult situation, trying to capture market share while essentially trying to cut costs (usually, capturing market share comes at the cost of increased marketing expenses or similar things). Meaning the company will have a hard time growing while at the same time capturing many of those efficiencies.

So, what can we say about Molson Coors?

We can say that the company is improving things along the line of its overall plan – and many of the company’s fundamental targets are currently being realized.

However, at the same time, it’s hard to see how the company will be able to grow its business efficiently while saving money, without spending more on sales, marketing, travel, and personnel – as we’ve seen G&A already rising in the past quarter.

Let’s look at how these trends have impacted valuation for TAP, and really update the company for the first time in over a year.

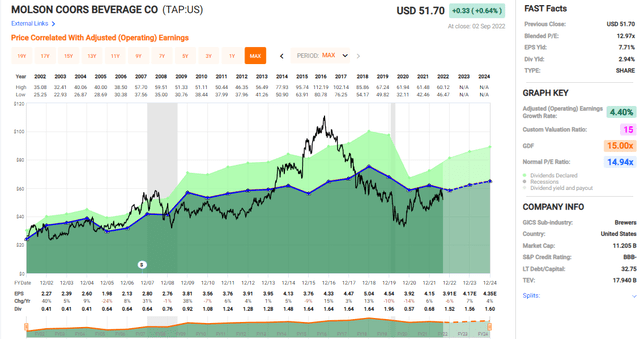

We have a company that is continuing to deleverage significantly and is improving its overall fundamentals. As I said, the company has been on “quite a trip” for the past 10 years or so. We’ve seen extreme highs and extreme lows. Take a look at this trend.

TAP valuation (F.A.S.T Graphs)

TAP valuation (F.A.S.T Graphs)

I would hesitate strongly to apply any significant sort of premium to a company that is expected to not improve its EPS massively, and that has this sort of competitive situation and a sub-3% yield. While in context, this is on the high side for the sector, there are still potential downsides to be had for the company.

As you can see, valuation is key here. The company has traded at a clear premium for the past 10 years of around 16x earnings – or even above that -, while growth has been sub-par at below 6% per year, justifying far lower fair-value P/E.

The growth rate based where the company should be trading according to valuation methodologies such as GFD ratios, smoothing out P/E volatilities, call for the company to trade between 11-12x P/E. This would suggest that the company’s upside is no higher than 3% per year here.

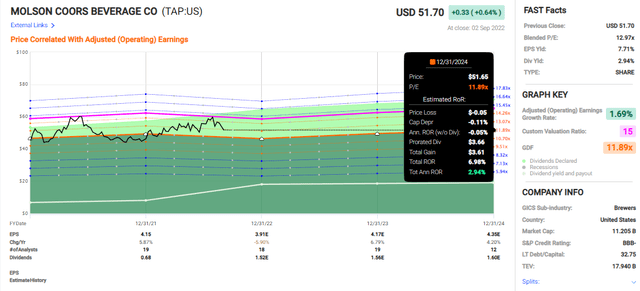

TAP Upside (F.A.S.T Graphs)

TAP Upside (F.A.S.T Graphs)

Not exactly impressive when we compare to what is available on the market today. Even if we consider a more historically accurate 5-year average, this calls for no more than a 7.5% annualized RoR. When we consider the BBB- credit rating, the lower yield, and the lack of a growth rate, we start to see some of the issues here – at least insofar as valuation goes.

The question that investors need to consider following this is if the company could justifiably keep going up from here, based on results and valuation.

The article title should indicate my view on the matter – even if the company hits its 2022 forecast, this forecast essentially promises only very slight growth from fairly so-so results in 2021, and the next few years aren’t promising to deliver any massive improvements either.

Molson Coors continues to combine three of the worst trends I know in a dividend company – though one of these isn’t as much of an issue any longer.

First, very little expected EPS growth – and given how the company has struggled and failed to turn around, you’d be going against the grain expecting more here.

Second, a small dividend

Third, the company, despite all this and its lack of growth and safety, isn’t even all that undervalued. At an average weighted P/E of around 13X, the company is what I would consider at best somewhat “fairly valued” for what it’s expected to offer in the next 3-4 years.

These are really the problems with TAP – problems that Constellation Brands both have better growth prospects. They’re higher valued, yes, but they’ve also realized some of the efficiencies that TAP is looking for, enabling them to generate growth in the double digits. Something TAP is currently not even themselves forecasting being able to do.

Because of this, I’m tepid on TAP – for the time being.

I’d want to see the company lower – even if the analyst average here is calling for an average price target of around $56/share here. But this average, despite the undervaluation, comes with “BUY” recommendations from only three out of eighteen analysts, showcasing just how confident these analysts are with that target.

My own forecast is far more modest – and I’d want to see TAP in the 40s before really being interested in the business.

Say around $48/share – at the highest.

My thesis is the following:

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

Thank you for reading.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

36 year old DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have a beneficial long position in the shares of STZ, BUD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks I write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company’s domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.